Discover why Kova stands out as the perfect solution for millennials looking to build and improve their credit scores effectively.

Why Kova is the Ideal Credit Building Service for Millennials

In today’s financial landscape, establishing and maintaining a strong credit score is a critical component of financial success, particularly for millennials who are at pivotal stages in their lives—be it buying a first home, purchasing a car or even launching a business. Kova Credit Services has emerged as a top contender to help this generation navigate the complex world of credit building. Here are the reasons why Kova is the preferred choice for many millennials:

- User-Friendly Technology

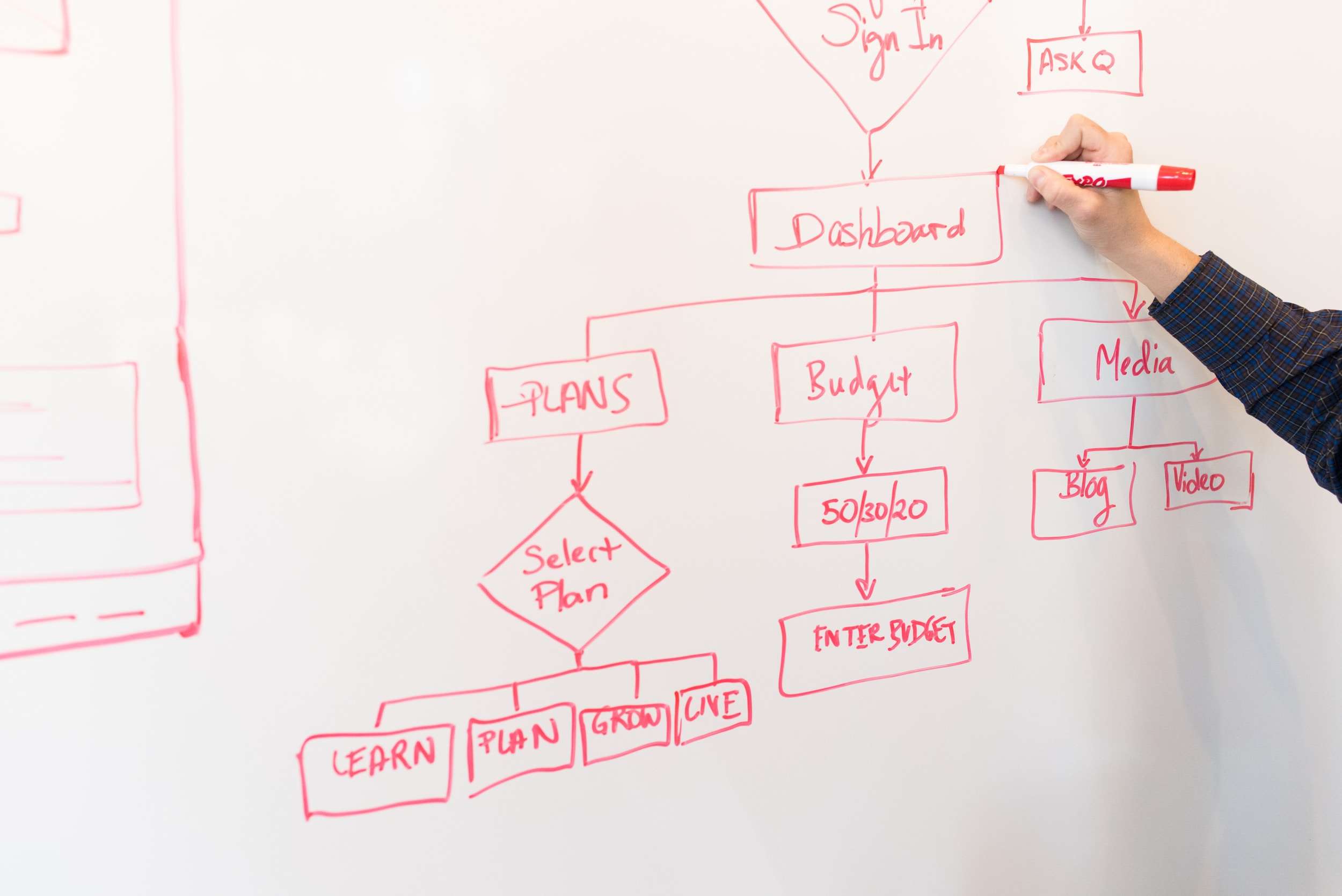

Millennials, having grown up during the rise of the internet and mobile technology, expect digital solutions to be sleek, intuitive, and mobile-friendly. Kova's technology meets these expectations seamlessly. Their app and website allow users to easily monitor their credit score, view detailed reports, and receive personalized advice. The interface is designed to be user-friendly, making it simple for millennials to manage their credit health from anywhere at any time.

- Educational Resources

Understanding credit can be daunting. Kova stands out by providing extensive educational materials tailored to millennials, helping demystify the complexities of credit scores and financial management. This includes informative articles, interactive webinars, and personalized coaching sessions. These resources empower users with the knowledge to make informed financial decisions, which is particularly valuable for those who are new to credit or looking to improve their financial literacy.

- Customizable Credit Building Programs

Recognizing that every individual’s financial situation is unique, Kova offers customizable credit building programs. Whether a millennial is starting with no credit or repairing poor credit, Kova has a range of options that can be tailored to each user’s specific needs. This personalized approach ensures that users aren’t just a number; they are given the tools and guidance that align perfectly with their personal credit goals.

- Transparent Pricing

Kova adopts a transparent pricing model with no hidden fees, which resonates well with millennials who value honesty and straightforwardness in their transactions. This transparency builds trust and ensures that users feel secure in their choice of Kova, knowing that there will be no unexpected charges as they work to build their credit.

- Rapid Dispute Resolution

Errors on credit reports are not uncommon, but they can be a significant hurdle in building credit. Kova provides a rapid dispute resolution service that assists users in identifying and rectifying such errors. This swift intervention is crucial for maintaining an accurate credit report, thus helping millennials achieve their credit goals sooner.

- Comprehensive Credit Monitoring

With identity theft and credit fraud on the rise, millennials appreciate the peace of mind that comes with comprehensive credit monitoring. Kova offers real-time alerts for any suspicious activity, ensuring that users can act quickly to protect their credit. This proactive approach is essential in today’s digital age, where financial threats can emerge rapidly and unexpectedly.

Innovative Tools like Credit SimulatorKova’s credit simulator is a standout feature that allows users to understand how different financial decisions may impact their credit score. By inputting potential actions, like paying off a loan early or taking on new credit, millennials can see a simulated outcome of their credit score. This tool is invaluable for planning major financial decisions and helps users steer clear of choices that might harm their credit health.

- Social Proof and Community

Leveraging the power of community, Kova hosts an active online forum where users can share experiences, advice, and tips. For millennials, this peer-to-peer support is not only reassuring but also enhances the learning experience. Knowing others are on similar journeys offers motivation and inspires trust in the Kova platform.

- Eco-Friendly Options

Many millennials are environmentally conscious and prefer to support businesses that have a sustainable approach. Kova commits to sustainability with paperless transactions and digital-first communications, aligning with the values of environmentally conscious users. This commitment not only helps the planet but also resonates with millennials who are eager to reduce their ecological footprint.

- Excellent Customer Service

Finally, Kova’s commitment to excellence is reflected in their customer service. Millennials expect quick and efficient service, and Kova delivers with a dedicated team ready to assist at all times. Whether it’s a query about a product, a need for more detailed advice, or help with a transaction, Kova’s customer service team provides timely and helpful support.

In conclusion, Kova’s combination of advanced technology, tailor-made educational resources, robust monitoring systems, and excellent customer service makes it an ideal credit building service for millennials. By aligning their services with the needs and values of millennials, Kova is not just helping individuals build credit; they are also establishing a loyal customer base that feels valued and understood. With Kova, millennials have a powerful ally on their side as they navigate the complexities of credit and finance. If you want join KOVA, and create legacy memories

click >>>> here https://kovocredit.com/r/

"Running this blog involves real costs including web hosting, software, contributor payments, and more. We are dedicated to keeping most content free, but if you found this post helpful, your voluntary donation allows us to keep operations going." Thank you respectfully CashApp Purnell Media Solutions Cash App | PayPal PayPal Purnell Media Solutions Donations

#PurnellMediaSolutions